The Trump administration has made its position crystal clear: Nvidia’s cutting-edge Blackwell chips will remain strictly off-limits to China.

In remarks across multiple platforms, from a CBS “60 Minutes” interview to comments aboard Air Force One, President Trump declared that the company’s most advanced semiconductors belong exclusively to American companies.

“We cannot sell them to China. We cannot sell them to other people,” Trump stated flatly, emphasizing that these aren’t just any chips but rather technological powerhouses that sit a full decade ahead of competing systems.

For Nvidia, which has built its dominance on unrestricted global access, this represents a significant tightening of an already constrained environment.

The company currently counts itself essentially exiled from the world’s second-largest economy after shifting from a 95% market share to zero.

Nvidia Blackwell chips: The Treasury’s intriguing twist

Here’s where things get interesting. While Trump was slamming the door shut, Treasury Secretary Scott Bessent quietly opened a window.

Bessent suggested that high-end Nvidia chips could eventually reach Chinese companies, hinting at future negotiations between Trump and Chinese President Xi Jinping.

His rationale? Technological evolution might render today’s “crown jewels” less formidable in tomorrow’s landscape.

It’s a tantalizing possibility that directly contradicts Trump’s public hardline stance, signaling potential flexibility as geopolitical winds shift or as the tech frontier inevitably advances.

Interestingly, this isn’t the first time such tensions have played out.

Earlier this year, Nvidia and AMD agreed to share 15% of their China revenues with the US government in exchange for export licenses, a groundbreaking arrangement generating approximately $3.48 billion annually for the Treasury.

That deal applied to less advanced chips like Nvidia’s H20 model, which Trump dismissed as “outdated.”

The arrangement essentially created a new revenue stream while maintaining national security guardrails, though critics argued it still posed risks to American technological advantages.

South Korea cashes in

Meanwhile, South Korea is cashing in.

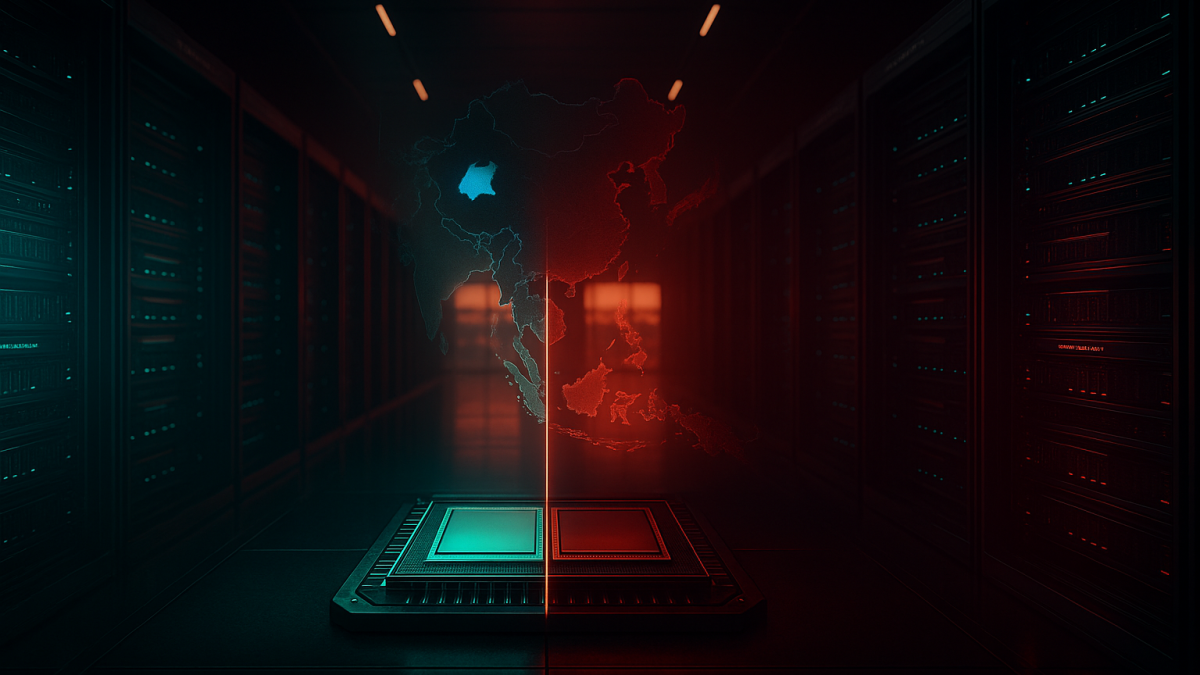

Nvidia recently announced plans to supply over 260,000 Blackwell chips to major South Korean companies, including Samsung Electronics, a stunning contrast to China’s complete exclusion.

This geographical selectivity illustrates the current geopolitical reality: allied nations enjoy access while strategic competitors face walls.

For Nvidia, the immediate reality is painful.

The company isn’t currently applying for permission to export Blackwell chips to China, and CEO Jensen Huang’s cautious optimism,”I hope so someday,” rings hollow against Trump’s declarative rejections.

Yet Bessent’s comments suggest the American government isn’t entirely committed to permanent barriers.

The Treasury’s hint at future possibilities, combined with technological obsolescence timelines, indicates that today’s Blackwell restrictions might not be tomorrow’s policy.

The real story isn’t what happens now; it’s watching whether Washington’s hardline posture eventually softens when geopolitical calculus shifts or when newer technologies emerge.

The post Nvidia’s Blackwell chips: Trump denies China access, but Treasury hints at future shift appeared first on Invezz