The USD/JPY exchange rate has crashed this week as investors move to the safety of the Japanese yen as global risks remain elevated and demand for Japanese bonds rise. The pair dropped to a low of 143, its lowest level since September last year. It has dropped by almost 10% from its highest point this year.

Japanese yen as a safe haven currency

The USD/JPY pair plunged this year because of the ongoing rush to safe havens due to Donald Trump’s tariffs.

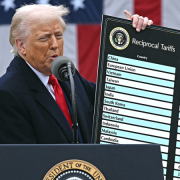

Trump launched his Liberation Day tariffs last week, triggering a major sell-off of risk assets like stocks and cryptocurrencies.

These fears eased slightly this week after he announced that he would pause tariffs to some countries, including Japan. He also seemed to prioritize Japan, one of the countries to call his administration.

Analysts believe that Japan may avoid US tariffs if the government makes serious commitments to boost US purchases, especially natural gas and crude oil.

Experts believe that geopolitical risks remain elevated. For one, the US is still charging a 10% tariff on most imports and a 25% levy on steel, aluminum, and vehicles. Most importantly, the US has boosted tariffs on Chinese goods to 145%.

Therefore, there is a likelihood that the US will sink into a recession this year if Trump does not remove the tariffs.

It was encouraging to see the President reverse himself on the so-called “reciprocal” tariffs yesterday, but I wouldn’t take much solace in it as the global trade war continues to rage. I still put the odds of a recession this year at 60%.

In such periods of geopolitical risks, investors usually move to safe havens, and the Japanese yen is one of the safest because of its vast international assets.

The USD/JPY pair has also crashed because of the rising Japanese bond yields. Data shows that the ten-year yield jumped to 1.35% on Friday from this month’s low of 1.05%. These yields have risen from zero last year as the Bank of Japan has hiked interest rates.

Analysts believe that the BoJ will pause its interest rate hikes and then hike again once the ongoing trade tensions cool. In a note, one analyst said:

“With the economy gaining momentum and political conditions relatively stable, JGBs (Japan Government Bonds) offer a solid investment case. We are starting to see that obviously JGBs had some value at about the 1.5% levels.”

USD/JPY technical analysis

USD/JPY chart by TradingView

The daily chart shows that the USD to JPY exchange rate has been in a strong downward trend in the past few months. This crash happened as the divergence between the Fed and the BOJ rose. In this, the BoJ has been hiking interest rates, as the Fed has paused.

The pair has recently dropped below the key support at 148.71, its lowest level on December 3, and 146.58, its lowest swing in March. It invalidated the double-bottom pattern as it moved below the key support at 146.58.

The pair also formed a death cross pattern as the 50-day and 200-day moving averages, Also, the Average Directional Index (ADX) has jumped to 25, a sign that the downtrend is gaining momentum.

Therefore, the pair will likely continue falling as sellers target the next psychological point at 140, which is also its lowest level in September last year.

The post USD/USD forecast: here’s why the Japanese yen could surge to 140 appeared first on Invezz